Is AI the Ozempic for Financial Companies?

AI is transforming finance like Ozempic does metabolism, boosting efficiency, decision-making, and growth while reshaping roles, risks, and regulations. In the “do it for me” economy, the winners will be those who leverage AI to gain muscle, not just lose weight, augmenting human expertise rather than merely cutting costs.

Underwriting discipline, the key to specialty finance

Fintech specialty finance originators (FSFO) need equity investors who balance growth and profitability, focusing on capital efficiency, cash flow, and sustainable unit economics. Disciplined FSFOs can achieve premium valuations, delivering strong, risk-adjusted returns for shareholders over time.

Chasing Hypergrowth? You Might Be Missing the Best Investments

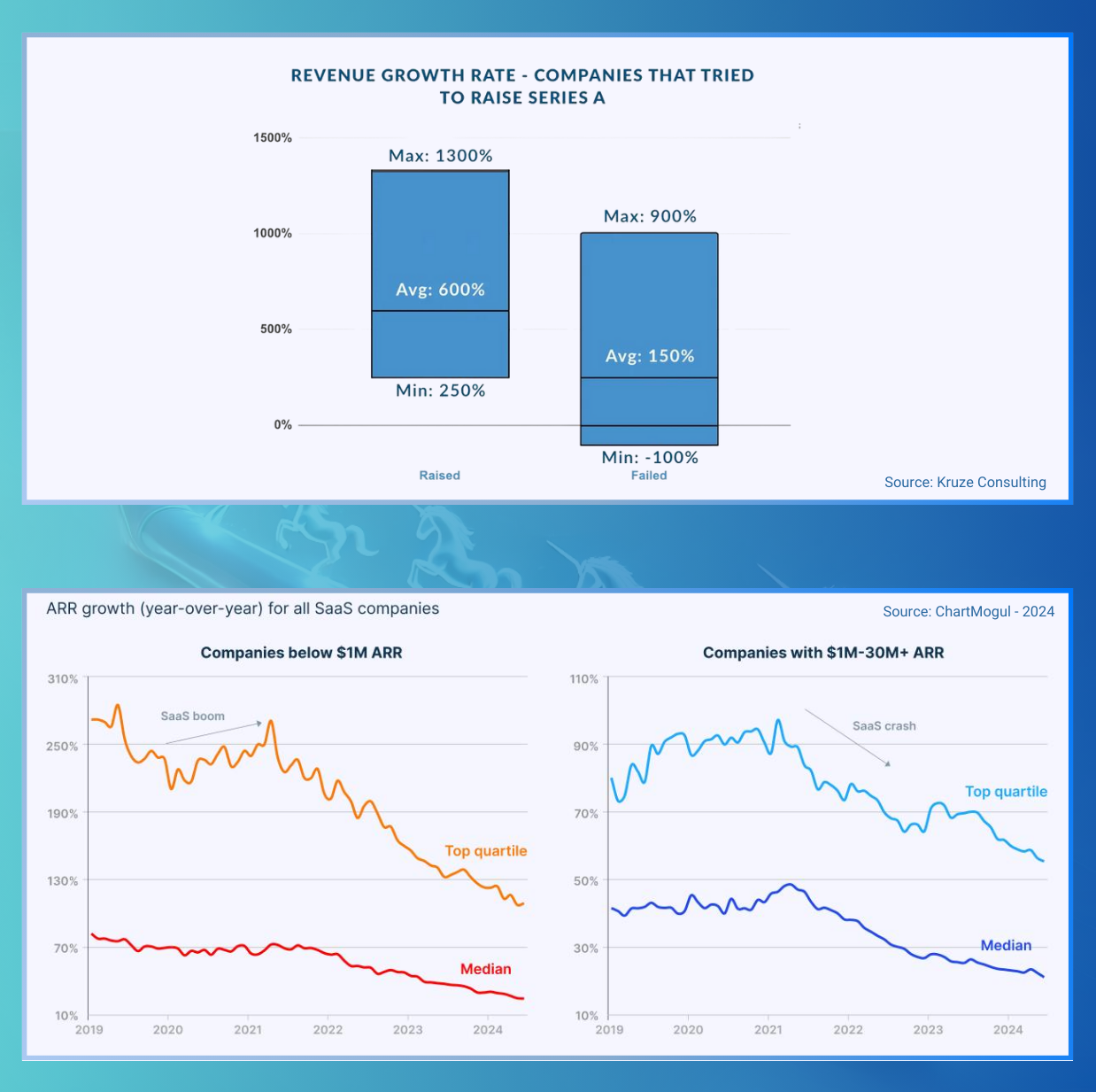

While startup cohorts has kept growing, unicorn rates are declining. Despite rising valuations, hypergrowth expectations outpace actual startup growth (30–60%). With 10,000+ funds competing, capital concentrates in top-tier startups, sidelining solid but slower-growing businesses. To unlock value, investors must support sustainable growth.

Are banks facing a generational shift?

Banks are gradually morphing into backbones of fintech innovation, blending their compliance expertise with technology. They could end up reaping the benefits of hindsight in their efforts to support newer fintech solutions.

Is profitable scaling the new frontier?

Startups are shifting from "growth at all costs" to sustainable, profitable scaling. With tighter funding, high CAC, and pressures on LTV, fintechs are diversifying, optimizing unit economics, and focusing on efficiency. Success hinges on building scalable platforms and partnering with investors for sustainable growth.

Is SaaS Becoming “Service as a Software”?

SaaS is shifting from product-focused to outcome-driven models, powered by AI "copilots" that allow businesses to focus on quality services. This evolution enables outcome-based pricing, tying costs to measurable customer success. SaaS growth now demands adaptable strategies and investor support for scalable value delivery.

Is sharing financial data caring?

Rule 1033 empowers consumers with data control, promoting competition and financial inclusion by enabling permissioned data sharing, helping underserved consumers access valuable services. Some provisions like annual reauthorizations may slow adoption of beneficial services like credit score improvement. A flexible, transparent approach from all players could make data-sharing truly consumer-focused.

Go funded or fundless?

The McGuireWood Independent Sponsor Conference highlighted a growing shift in lower middle market private equity toward fundless, deal-by-deal investment models, offering more flexibility and alignment with stakeholders. Increasingly, firms led by operators are focusing on specialization, value creation, and equity upside, with trust and deep industry expertise becoming crucial for success.

Does strategic money win better?

Financial technology (Fintech) startup executives and their boards should consider engaging corporate investors as an alternative way to leapfrog competition. The right CVC can provide tangible strategic augmentation through early commercial endorsement and referenceability, while creating implicit downside protection.

Can AI agents outsmart SaaS?

The traditional SaaS model is being challenged by AI and smart agents. Companies need to reimagine their product and operations around data, efficiency, and find the right capital solutions to sustain growth.

If they come, will they stay?

Retention-first companies are built to last. The efficiency paradigm, paired with capital solutions that offer real operational expertise, is the new playbook for increasing company value.

Is Intelligent Augmentation The Next Big Thing In Financial Planning?

Financial planning is about to change. Intelligent augmentation isn’t just about improving accounting—it could fundamentally reshape how businesses manage their finances, creating opportunities for more strategic, real-time financial decision-making.

Don’t throw the baby out with the BaaS water

Recent challenges from a few middleware players have raised questions around BaaS (Banking as a Service). Yet, BaaS will continue to have a durable impact on enabling embedded finance. With their established risk and regulatory practices, banks may have a front-row seat.

Is WealthTech the future of advisory?

With the upcoming $68 trillion generational wealth transfer, WealthTech is making wealth management accessible to the masses, with digital solutions catalyzing more personalized adoption and engagement. Creating smart experiences for the net new users is where traditional advisors can add more value.

Move money or make money?

From embedded finance to real-time payments to tokenization, digital payments are not just changing how transactions occur but also unlock opportunities for individuals, businesses and investors alike.

Can Nurturing the Overlooked Lead to Better Risk-adjusted Returns?

Significant value exists in lower middle-market venture-backed companies that no longer fit the hyper growth model but have viable offerings. It creates a unique opportunity for structured growth equity investors to sustain innovation and generate significant risk-adjusted returns, filling a gap between venture capital and private equity.

When it's not primary, is it secondary?

VCs remain cautious but selectively optimistic amidst a backdrop of economic adjustments. Investors are showing a growing appetite for alternative liquidity options such as secondaries. Structured growth equity strategies could offer diversification into a less volatile asset class while also supporting the startup and VC ecosystem.

Is venture liquidity in stagnant waters?

Structured growth equity strategies could be a solution to the current venture illiquidity overhang by providing founders the capital and operational assistance to continue building, giving investors access to a long-term structural opportunity, and making the startup ecosystem stronger.

When it’s low, how can it bounce back?

Founders and investors should consider alternatives for startups that don't exhibit the potential for IPOs or fund-returning outcomes. Structured growth equity strategies could keep mid-stage startups in business by injecting capital and recalibrating their operations until their economics, not just market, bounces back.

Can founders get a second bite at the apple?

Most startups, in Fintech and beyond, are meant to be steady businesses with product market fit, loyal customers and robust growth. For founders who won't achieve a venture scale outcome, structured growth equity is a viable financing solution that combines capital with operational expertise, and preserves significant upside for founders.